Below are the major contributing factors and their impact on your credit score:

HIGH IMPACT

- Payment History: Percentage of payments you’ve made on time

- Credit Card Utilization Ratio: How much credit you’re using compared to your total credit limits (the lower the percentage the better)

- Derogatory Marks: Collections, tax liens, bankruptcies or civil judgments on your report

MEDIUM IMPACT

- Credit Age: Average age of your open accounts

LOW IMPACT

- Hard Inquiries: Number of times you’ve applied for credit

- Total Accounts: Total open and closed accounts (closed accounts drop off of your report 10 years from the date it was opened)

Be Smart

Pay on time! The key to maintaining a good credit score is paying your credit card statements in full and on time. This seemingly simple concept plagues millions of people who struggle to keep up with high interest rates that ultimately lead to their credit score’s demise. By paying in full and on time, you’ll avoid taking a hit on all three of the High Impact metrics mentioned above.

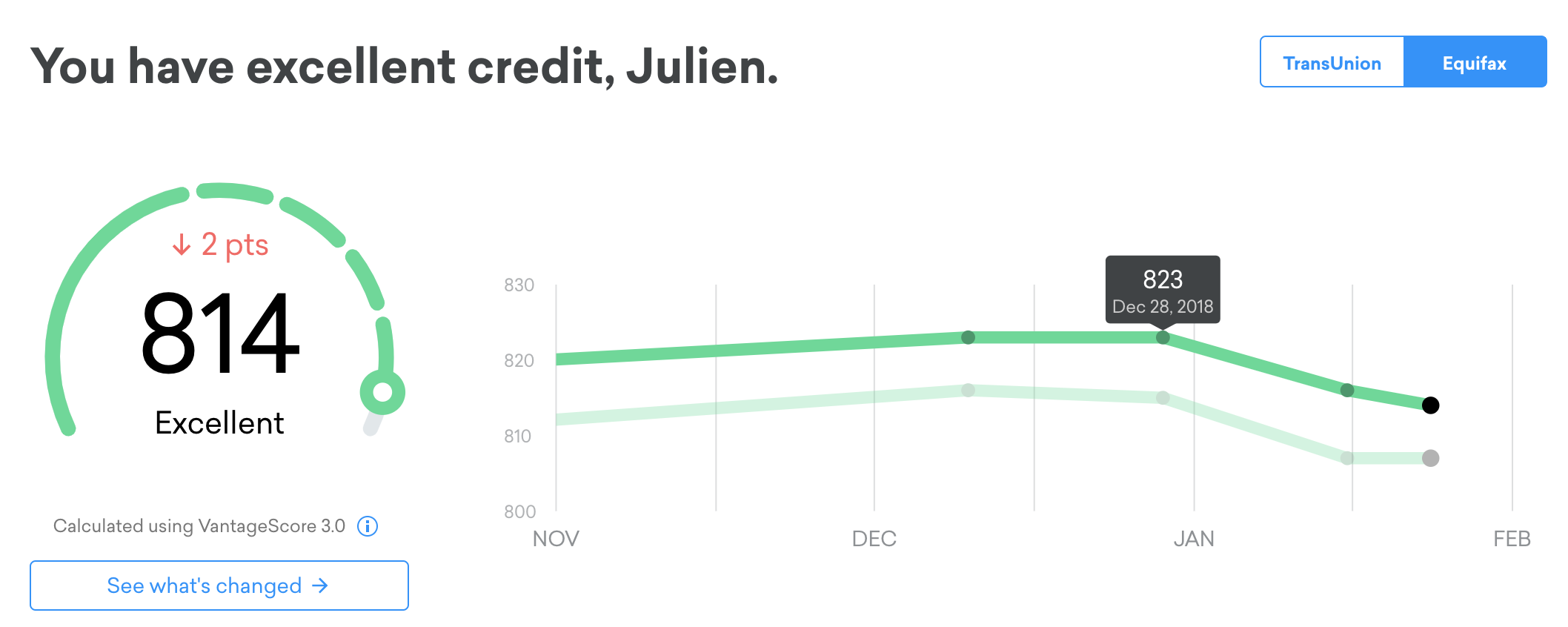

Opening Multiple Credit Cards

There’s a common misconception that opening multiple credit cards can adversely affect your credit score. Admittedly, after opening one or more cards, your score will drop a couple of points, however with 3-4 months your score will spike higher than where it previously was. That’s because you’re initially increasing the hard inquiries and total accounts (Low Impact). But soon enough, your credit utilization ratio and payment history (High Impact) improve and your score is propelled by these more important metrics. Not to mention you’ll be benefitting from multiple sign up bonuses that can provide you with free travel and cash back.

The Effects of Closing a Credit Card

It’s important to note that when considering closing a credit card, you assess the impact this has on your score both in terms of credit utilization ratio and credit age. The best scenario is to either downgrade your credit card to a card with no annual fee so that you maintain the credit limit and the credit age. If you still need to close the card, try transferring the credit limit to another card belonging to the same issuing bank (i.e. Chase or American Express) so that you maintain your credit limit and low utilization ratio.

Best resource for understanding and monitoring your credit score for free: creditkarma.com.

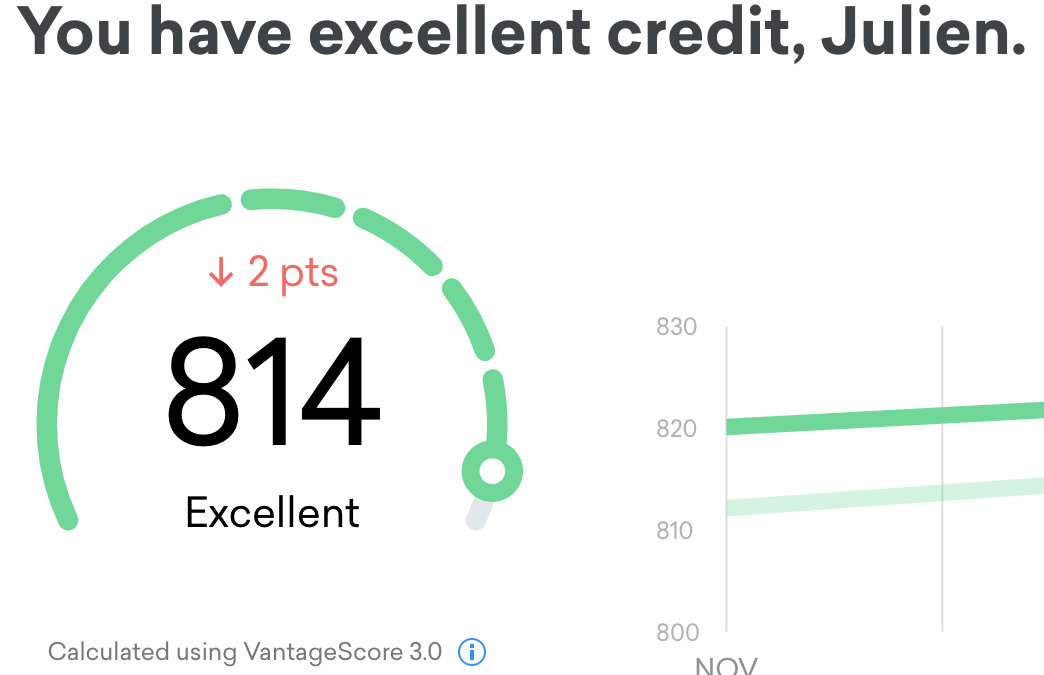

After applying for 3 new credit cards in mid-September, my score took an initial hit but has rebounded nicely after consistently paying off my cards on time and by increasing my credit card utilization ratio.