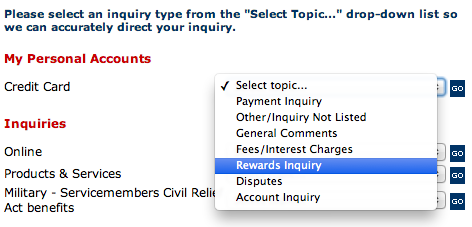

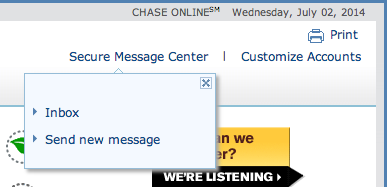

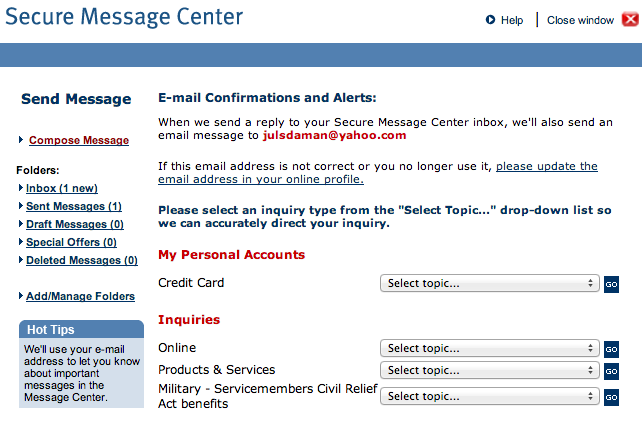

I’d like to address why I think sending a private message to your credit card company is such a great perk that comes with your card. I contact my card’s company whenever I have a question, inquiry, or request and I usually receive great service. In the past, I used to call the card company whenever I needed something and was either lucky enough to speak with someone who could help me or was stuck hanging up and calling again until I reached someone competent enough to process my request. Nowadays, I just send a private message and almost always receive the answer I want and it’s fantastic! Here’s how it goes:

Chase and American Express Private Messaging:

I send out a private message when I want to accomplish one of the following things:

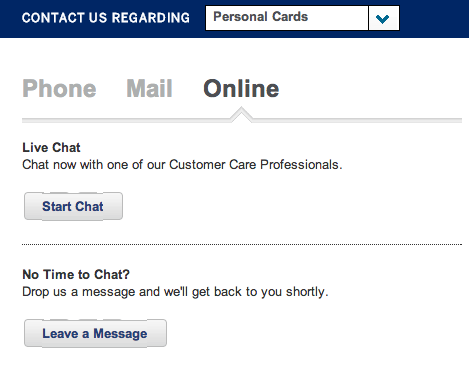

- I sign up for a credit card and receive the standard sign up bonus for that card, only to find out Chase or Amex is increasing the sign up bonus for a limited time right after I opened the card. So frustrating! I have had 100% success rate having the increased bonus honored by Chase as long as it’s within 90 days of card opening and I’ve had a 0% success rate with Amex. You’re more likely to get help from Amex if you chat with an online representative than sending them a private message. Last year I applied for the Starwood card from Amex right before they came out with the increased offer of 30,000 points and they would not honor it. I’ve used screenshots from offers I found online and old offers from years past and used them to leverage hundreds of thousands of extra points with my Chase Sapphire Preferred, Chase Ink Bold, Chase British Airways, and Chase United MileagePlus Cards!

- One of my credit cards has just been hit with an annual fee and I either want to close it, downgrade it, or ask for the fee to be waived or find out if any type of retention bonus can be offered to me. Private messaging Chase asking them any of these questions and they will take care of it for you without a problem.

- I just live chatted with a representative at Amex to transfer credit over from one of my SPG cards to another in order to not lose the credit on that card when I close it. It’s important to move your credit line from one card to another when you’re planning on closing it in order to keep your credit utilization ratio low and your credit score high. If you close a card with a $10,000 credit limit, you will lose that $10,000 credit that goes towards your credit score. Instead of having $100,000 worth of credit limit for all of your credit cards, you will now have $90,000 and your ratio will increase as you continue to spend money. If you ever need to close a card with Chase, just send them a private message and they will confirm it for you within a couple of business days.

Whatever questions you may have, experiment and try your luck with private messaging. Send your credit card company screenshots, ask them to honor promotions, bonuses, or targeted offers, and try again if you don’t reach a representative that will help you, because there will almost always be a representative out there that is willing to help.

If you have had success with contacting your credit card company with any inquiries and saved yourself thousands of points as well as precious time, then please share below in the comments!

When talking about canceling the card due to annual fee, do you find private messaging to be more effective than calling on the phone?

Great question. I’ve done both and it depends what you’re looking to do. If you would like to try your chances of getting a retention bonus and seeing if the credit card company is willing to offer you bonus miles to keep the card or to potentially waive the fee, then it’s definitely better to call up and ask. Otherwise, I’ve cancelled and downgraded cards with Chase by way of private messaging, and found it to be super easy without having to deal with a customer representative and wait on the phone for an extended period of time.

Anyone had any luck getting the annual fee waived on a Chase Business Mileage Plus Explorer Card? I’ve tried last year and they simply said no we can’t do that on this card – I asked them to waive it, but not to downgrade… I don’t want to give up my 2x miles on resaurants and gas