More like Shiti Bank

Background

Back in September, I took advantage of a limited time offer for the Citi ThankYou Premier Card to earn 60,000 points for spending $4,000 in 3 months. I was aware of the fact that Citi won’t deem you eligible for the sign up offer if you have the same card open and/or if you’ve received the bonus within the last 24 months. I previously had the Citi Prestige Card back in 2016 and closed it in 2018 due to the removal of many perks and benefits. Without the 4th hotel night free, complimentary rounds of golf, and other great perks, it just wasn’t worth paying the $450 annual fee anymore. In my mind, there was absolutely no connection between having a Citi Prestige Card that was closed 1+ year prior with a bonus that was received over 24 months ago.

Back to the Citi ThankYou Premier Card…I was approved instantly and was able to meet the $4,000 required spend within the first 3 months. As the following months ensued, I noticed that no sign up bonus was reflecting in my account. I started to chat with Citi reps through the website and they all claimed that I should expect the bonus in my next statement, but by the next 1-2 statements, there was still no bonus. Now I started to worry and decided to call Citi directly. The representative informed me that since I closed my Citi Prestige within the last 24 months, I was not eligible for the ThankYou Premier’s sign up bonus. I remember feeling shocked by the distant correlation between closing an entirely different card less than 24 months prior and not being eligible for the Premier’s sign up offer. I right away asked to speak to a manager who responded in a very angry and terse manner stating that the terms and conditions are clear and that I’m out of luck.

I don’t mind admitting when I’m in the wrong, but I truly felt slighted by Citi Bank and felt that their practices were very unfair. I’m well aware of how the major banks are cracking down on users who they feel are “gaming” the system and churning multiple credit cards per bank per year. However, I don’t like how Citi threw in a new clause into their terms and absolve themselves of any wrongdoing. At least American Express will notify you when you try to submit an application that you may not be eligible for the offer. You should be given the chance to extract your application prior to a hard credit pull, spending thousands on a card where they’re earning commissions, and then feeling like there’s no actionable recourse that can be taken.

Submitting a Complaint

After hearing more stories from friends who had similar and perhaps worse situations than mine: 1) A friend opened the Hyatt Card by Chase and a few weeks later, Chase decided that they made a mistake and automatically closed the card. 2) Another friend who only holds a few cards and spends a lot on them, got a targeted Amex Platinum offer. After being approved and spending the required amount, they were told by Amex they would not receive the bonus due to their new terms where they can determine whether a user might be “gaming” the system. I know for a fact this person spends tens of thousands on their cards and keeps them open for a long time. They don’t even have any other Amex cards!

Following these stories, I felt like action needed to be taken against the banks in any way possible to at least hold them somewhat accountable for their actions. After all, they’re the ones earning billions in credit card spend commissions and fees while passing along points that continue to be devalued by travel reward programs. Thus…

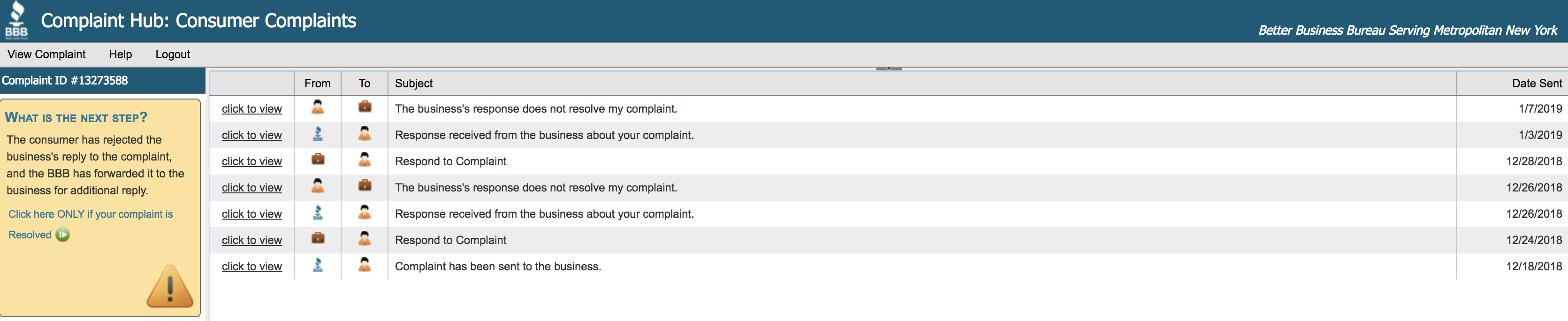

BBB

I decided to submit a formal complaint through the Better Business Bureau. I had never done this before and wasn’t sure what to expect, but I outlined all of my grievances and sent along my complaint hoping for the best. After a few back and forths from Citi saying they would respond in 15 business days, I finally received a voicemail from a Citi Bank compliance manager who said they would be mailing me a formal response and to call them back if I had any questions. I proceeded to call them back on 3 separate occasions, leaving voicemails, and never heard back. I finally received the later in the mail and this is what it said…

You should really be going through the CFPB if the complaint involves a bank… they carry much more weight than the BBB.

I started with BBB and they couldn’t do much for me. I’ll cover my experiences with other agencies in my next post.

Yup, I agree. CFPB is the channel to go for banks and especially for financial products. I filed mine against Chase after they dishonored the points by “updating the T&C” with a promo deadline to make the 1st purchase, after upgrading my Marriott Card. Still waiting for a resolution..

Thanks for the insight. I’m happy to hear that more individuals are taking action and not letting the banks continue to run their businesses like the wild west.

Yeah CFPB is way more appropriate and effective for this problem.

Sorry, but I think your case is hopeless. It’s well-known that opening OR CLOSING a card resets your 24 month clock with Citi, both for the TY and AA cards.

So, since you closed the Prestige, you would been eligible for the Premier bonus 24 months after closing the Prestige. Instead, you applied for the Premier less than a year after closing the Prestige = no bonus for you. The Citi manager is right that those terms are clearly stated on the application page.

I mean, if you can get the points, good for you – but the term were/are clear, and you’re clearly not eligible for the bonus, unless Citi decides to make an exception.

exactly. Don’t know what grounds you have to stand on when the terms are very clear.

In hindsight had a been aware of those terms, I would not have applied. Having said that, do you think it’s fair if you had the Chase Sapphire Reserve and Chase removed the Priority Pass, TSA Precheck credit, and some other perks and kept the $450 fee and you closed the card. A year later you apply for the Chase Sapphire Preferred and are rejected because you closed the Reserve, do you think the two are related or are you all for every bank setting arbitrary terms as they see fit?

I mean, I don’t agree with the restrictions, but they’re pretty well known. About your CSR example – Chase has a 48 month rule about the Sapphire cards (and 5/24 on top of it) – so if you closed the CSR, you wouldn’t be eligible for a CSP until 48 months after you had received the CSR bonus (for Chase, the date of closure of the CSR isn’t important). And you’re only eligible for the CSP if you have fewer than 5 new cards on your credit report in the past 24 months.

So, Chase is even MORE restrictive than Citi when it comes to sign-up bonuses and approvals.

I too wish the banks weren’t so restrictive with sign-up bonuses, but if you’re going to try to play the game, you’ve got to learn the rules first.

Good point. I think I’m most annoyed about being forced to close my Prestige in the first place. I loved the card’s perks and was fine with paying the $450 fee, but killing the best perks of the card gave me no choice.

well the 24 months restrictions had been in for years. the fact imho that Prestige got gutted & you canceled it had nothing to do with the bonus. I had Prestige in 2016, and got Premier and bonus after I waited 25 months. I did not touch Prestige just to be safe, you could have cancelled it after the bonus (& in your case the $450 fee, I was lucky in terms of timing).

Also – “At least American Express will notify you when you try to submit …” – this is weak as of last week no other banks is doing it, and not even that is not foul proof. Many cases of no-popup & no bonus.

I’m loving the hate mail. The hope is to establish a precedent, whether it’s with Citi or another major bank, where the consumer is not completely at the mercy of the banks’ arbitrary and subjective rules. They can choose to close accounts, withhold points, etc without any fear of legal action. I know for a fact that some of these accounts were not being gamed or churned in any way.

you should probably spend more time understanding the game than crying when you the banks won’t reward you for churning.

Haha no one’s crying, the point is that none of the big banks are held accountable when they go around closing people’s cards for vague reasons. The entire system is arbitrary and subjective. I’m more referring to my examples against Chase and Amex but I feel like it still applies to Citi.

Yep, I agree with the others. The rules are clear and you didn’t follow them. I’m not even sure what you hope to accomplish as you’re in the wrong not them.

I could understand the situation if you’re saying it’s been well over 24 months and you applied but from what you posted it was within 24 months so you seem to be at fault not them.

I definitely feel for you and can align with the anti-bank sentiment, especially as T&Cs get more and more vague and draconian.

On the other hand, your blog is hosted on boardingarea.com and I can hardly scroll one page down on that site any day of the week without finding someone hawking one of the Citi cards and putting in bold text the very clear restrictions so I’m honestly totally shocked that you, in this situation, would miss that.

I would feel slightly different for the average consumer on the street, though.

I’ll be honest, I was pretty mad and shocked at myself for having somehow missed the terms. I was on hiatus from posting or reading about new cards for a period of time there with a newborn child in the household. I’m not confident I’ll win this case, but my true goal is to try to inspire people to speak out against the banks and understand the various methods we have, as consumers, to voice our frustrations with the crushing changes across the industry.

Speak out against the banks for what, having rules so people don’t abuse the sign up bonus? The banks literally say you will not qualify for the bonus in the terms you signed on the application. You have the option of not using credit cards.

This is similar to TopCashBack cheating people out of money back on their purchases made through their site. They usually let the little money ones slide through, and say the big one referrals did not go through despite your proof to the contrary. I made a mistake using them and will not ever use them again. They may have the highest rates, but with poor customer service, what is the use? You might be able to sue in Small Claims Court using your state’s Consumer Protection statute, or at least report them to your attorney general for fraud.

The terms and conditions are pretty clear. The citi premier is in the same family as the citi prestige. You closed the prestige less than a year ago and are not entitled to the sign up spending bonus.

There are a lot of times when credit card companies are in the wrong but this is not one of them. In this case the bank should open a BBB complaint on you.

You’re wrong in this case. I support Citi’s POV. Their T&C were and are very clear. Citi Prestige, Citi Premier, Citi Preferred, etc are all part of ThankYou. I will voice my support for Citi via CFPB.

Bank is not wrong in your case and Chase account. Many time churners forget opening too many cards in a short period puts you in same category as fraudsters accounts and could result in closure even after approval. In your case, Citi 24 month rules are widely known and unfortunately you did not do your research prior to playing the game.

I agree Amex did your friend wrong. There is a case for CFPB complaint in that case.

nobody likes the 24-month restriction, so I agree witch you there– but, the first rule in the points game is to read the terms and conditions of the offers carefully before applying — and to keep track when you closed which card, and then the date by which you have to spend a certain amount of money.

It used to be that the 24-month clock was only for a specific product, now with Citi it’s for the family of cards — but, that was in the fine print when you applied.

No bank will award a bonus if you didn’t meet the requirements to the letter — and they can’t be expected to, just because of niceness. They did open the card you applied for, so if you really wanted it, you can use it. The “special welcome offer” is only paid if you satisfied all the requirements (because in that case they have to). If you only opened it for the bonus, they will not be “nice” and give it to you unless they legally have to.

Chase shutdowns are a different story, as are strange Amex points clawbacks — complaining against Citi will not affect those. I think you should drop the case and say “lesson learned”. Close the card, and 25 months later, reapply, and enjoy another signup bonus. In the meantime, there are other cards to get.

As far as the Amex popups, those are largely a negative change — or rather, a positive way to enforce a very negative change (it prevents useless credit hard pulls, but denies lots of people more signup bonuses). I REALLY hope that Citi never starts doing this kind of popup!

I’m not sure what recourse you’d have since the Citi policy on signups for their cards is well stated (albeit confusing). When I applied for the card, they printed right on the page with the new card that I wouldn’t be eligible for the bonus. My Prestige card was closed due to fraud and reissued but that also tripped their system. I opened a case with them and they honored the bonus for my case.

I’d much rather have a rule like Citi instead of AMEX’s new policy of not giving you a signup bonus if they feel you’ve gotten too many from them already but no one knows what that is until you go to apply.

You are such a noob blogger for not knowing this very common rule