Note: I do not receive credit card commissions from this post.

As the first month of 2019 comes to a close, the limited time credit card offers continue to pile up! While it has become quite evident that the top banks (Chase, Amex, Barclays, Citi, BofA to name a few) are cracking down considerably on users who open multiple credit cards or churn cards frequently, it just means I’ve become more selective as to which cards I apply. I’m only interested in maximizing sign up bonuses with the highest offers in the new year. So I’ve gone ahead and highlighted some of the latest fantastic sign up offers as you ramp up your plans for 2019 award travel.

- Limited Time Offer 75,000 Bonus – United Explorer MileagePlus Business Card

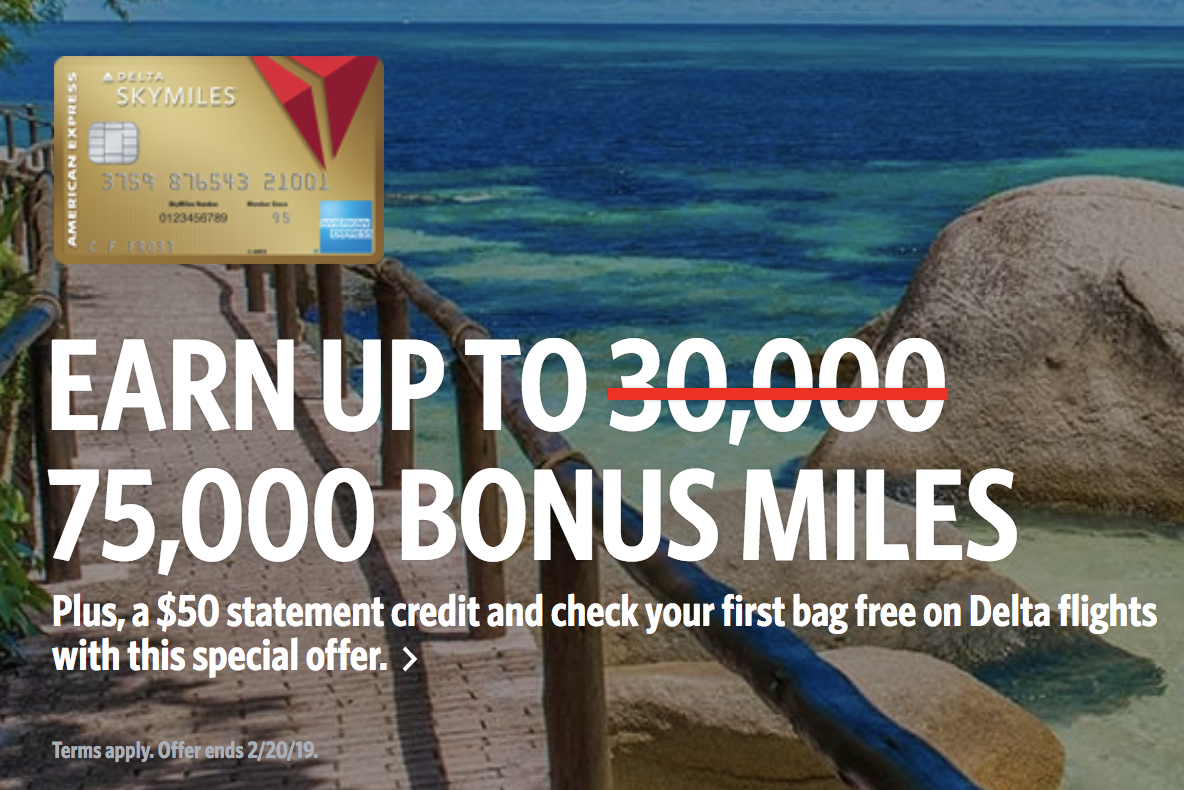

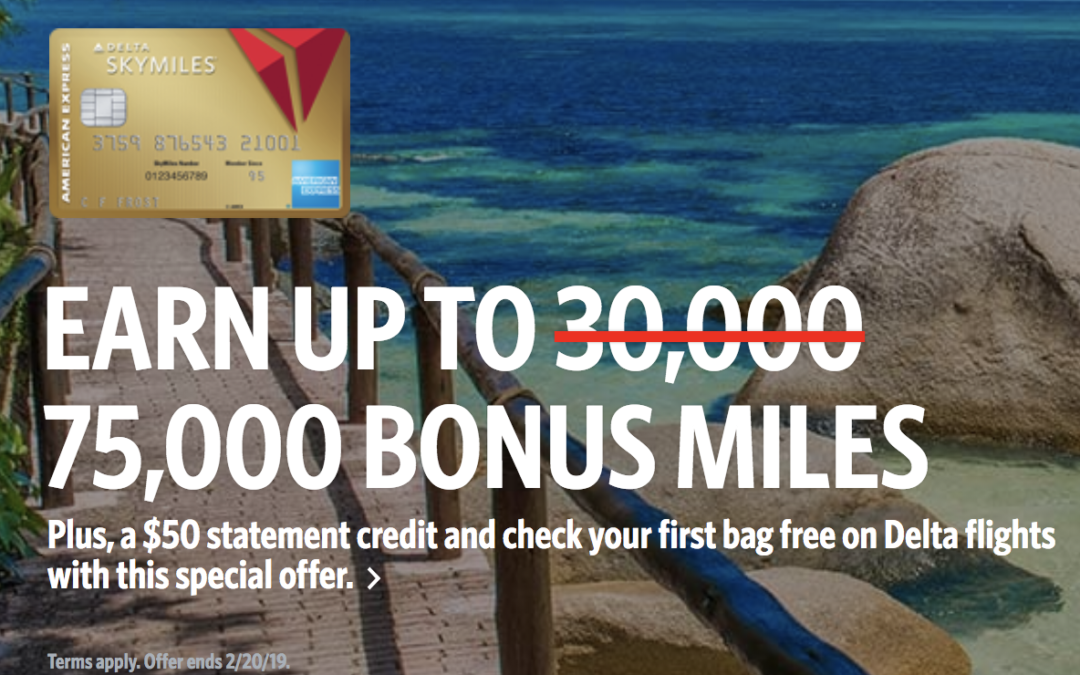

- Targeted: Limited Time Offer 75,000 Bonus (Consumer or Business) – Login to your Delta SkyMiles account and you will see this offer on the front page of Delta.com: Gold Delta SkyMiles Credit Card

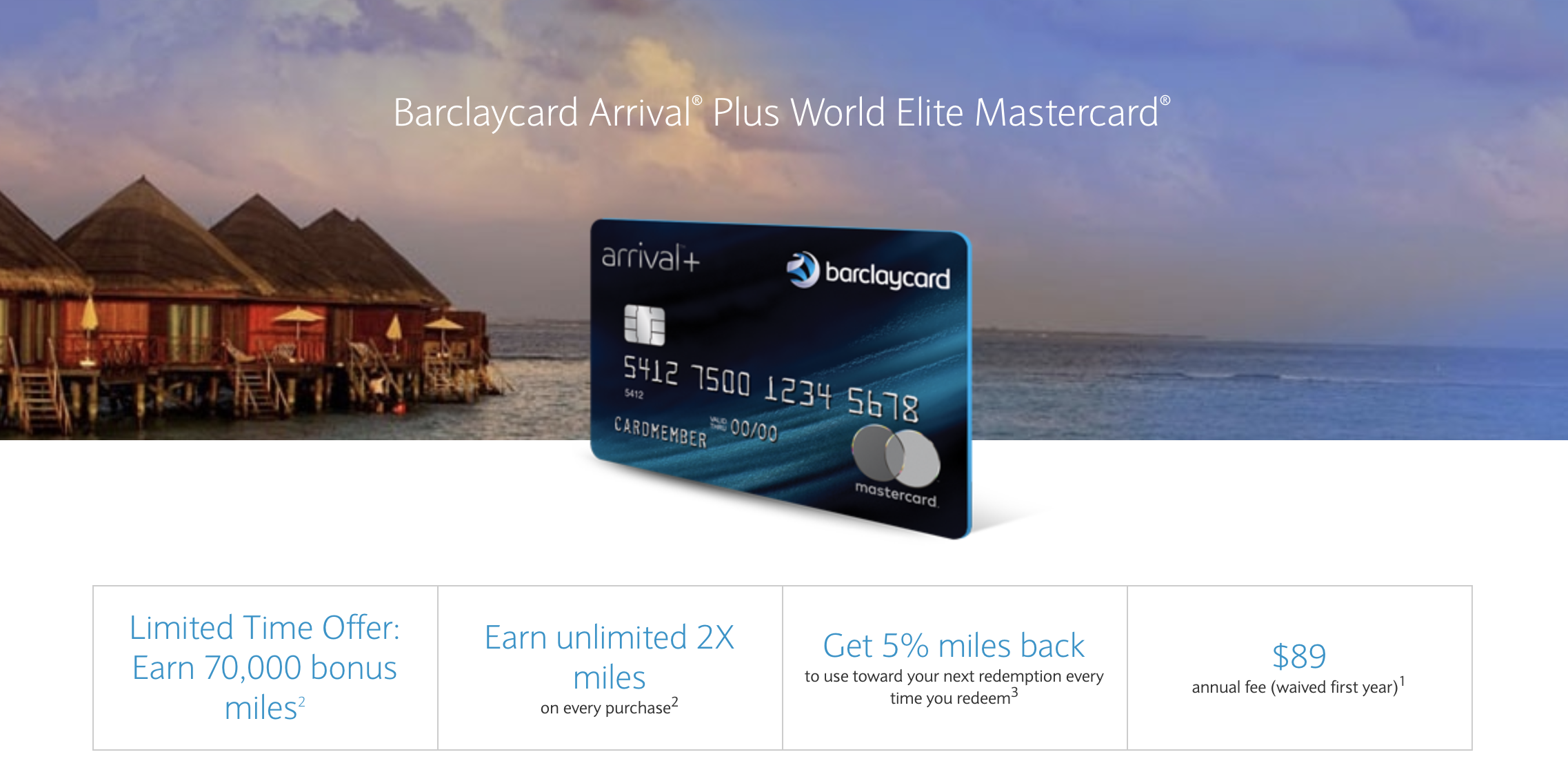

- Limited Time Offer 70,000 Bonus – Barclaycard Arrival Plus

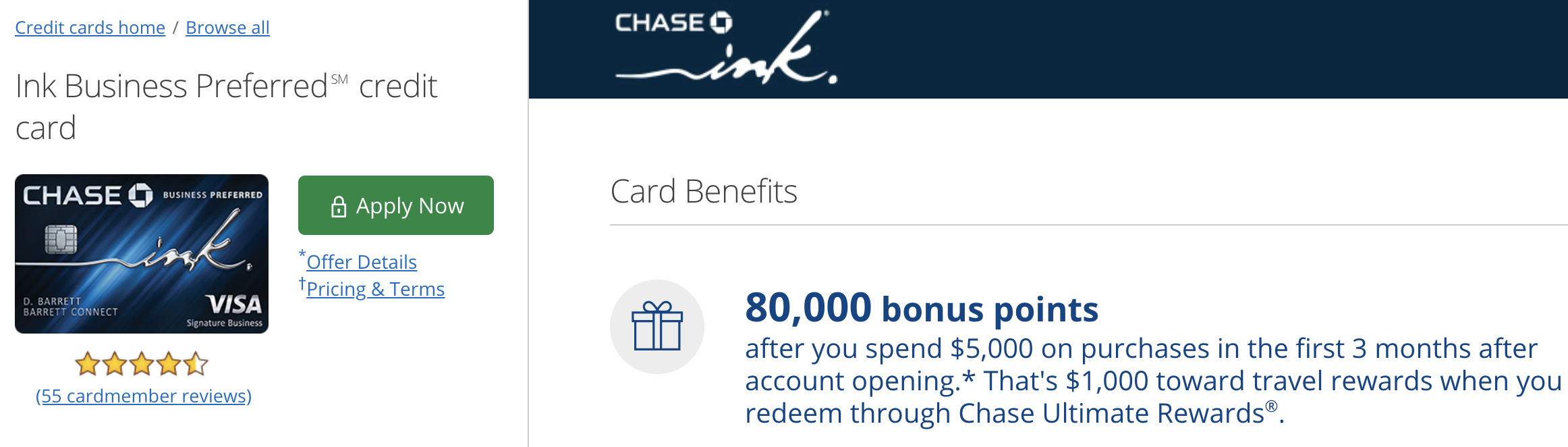

- Standard Offer 80,000 Bonus – Chase Ink Business Preferred

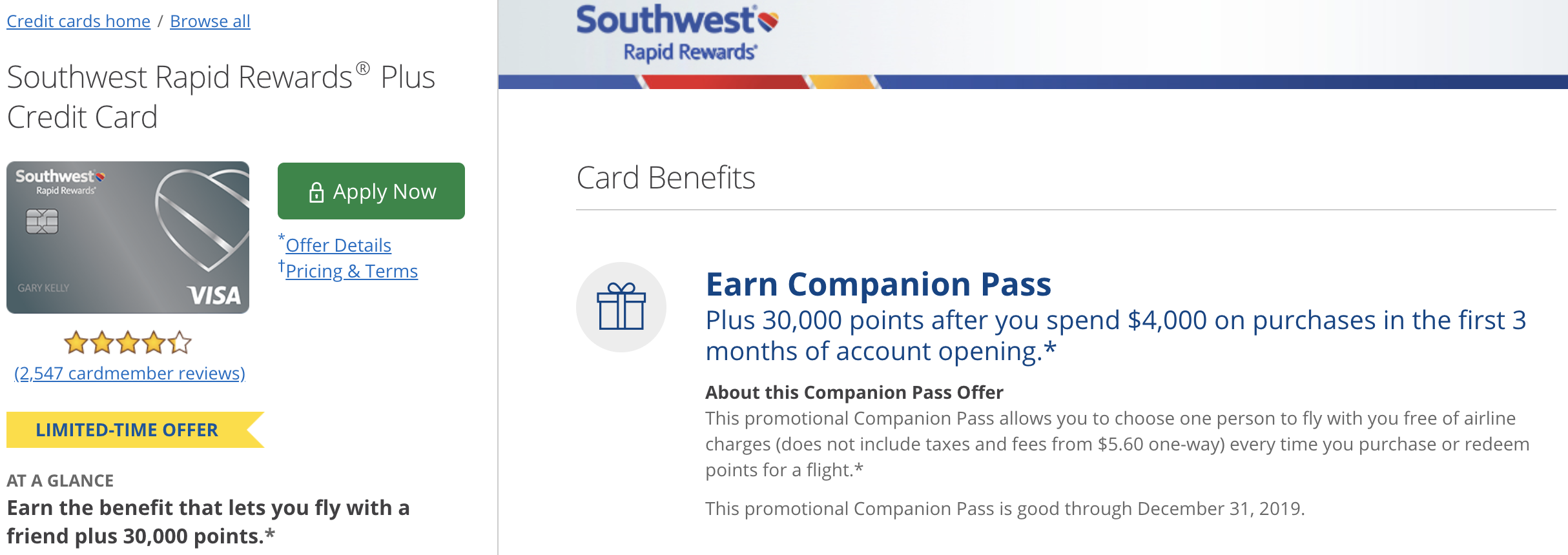

- Limited Time Offer 30,000 Bonus AND Companion Pass for 2019 – Southwest Rapid Rewards Plus Credit Card

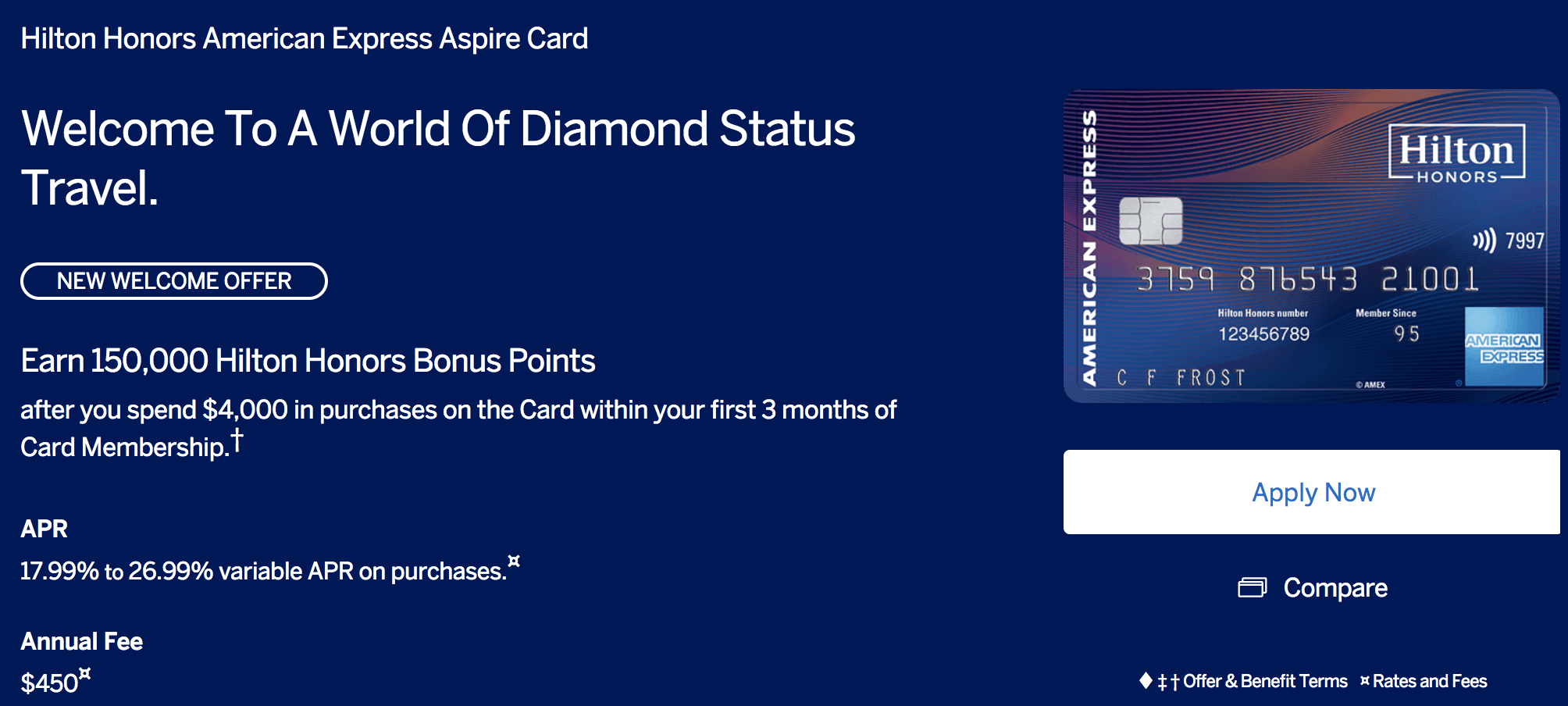

- New Offer 150,000 Bonus – Hilton Honors American Express Aspire Card

If you have any specific questions about any one of these cards, hit up the comments! For daily airfare, credit card, and travel deals, join my Facebook group!

Any idea how Barclays is on getting multiple cards? I know the restrictions on the other issuers that you mention.

I’ve been successful in the past applying for two different barclaycards and the same time using the two browser method for one hard credit pull but YMMV. Are you looking to apply for multiple cards or you already have 1+ cards with them and want another? You should be fine as long as you’re not applying for the same card if you have it open or cancelled but received the bonus within the last 24 months.

I’m trying to be greedy and get a card that I already have two of, but knowing the rules or guidelines helps in any case.

My understanding is that you won’t be eligible for the sign up bonus unless the card is closed and you haven’t received the original sign up bonus within the last 24 months. I’m curious to hear what happens though so let me know!

How is Barclays about issuing multiple cards?