Overview:

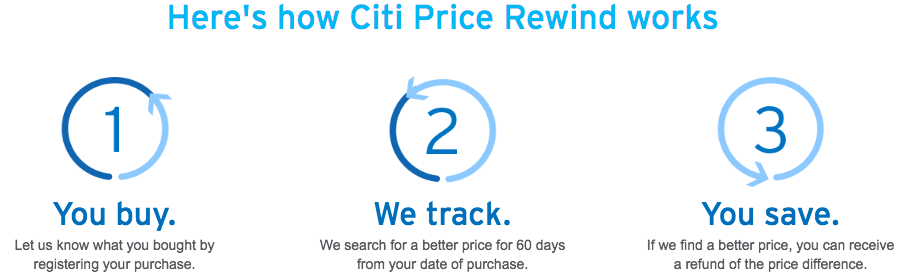

I recently wrote about why I think the Citi Prestige Card is one of the most valuable cards out on the market in terms of the sign up bonus and various benefits and perks that come with it. The other day, I also learned about the Citi Price Rewind – an extremely valuable benefit available to all Citi credit card holders. The Citi Price Rewind program searches for a lower price on registered items that you’ve paid for with your Citi card at hundreds of online merchants. If the same item is found at a lower price within 60 days of your initial purchase date, you may receive reimbursement of the price difference.

Citi Price Rewind tracks the online prices for purchases you have registered at www.CitiPriceRewind.com. It does not guarantee that it tracks all retailers or that it will find the lowest published price. If you find a lower published price yourself, you can request reimbursement of the price difference.

| How Long are you Covered | Within 60 days from the date of purchase |

| Maximum Coverage per item | Coverage is limited to the lesser of the following:

|

| Maximum Coverage per calendar year per account | $2,500 |

Terms:

- To be eligible for coverage, you must pay for the item at least in part with your Citi card.

- The lower-priced item must be the same as the one you purchased (including the same manufacturer, model number and color, if applicable).

- The lower price must be published on an online retail site or in a printed or online newspaper, magazine, store circular or catalog. Including special promotions such as Black Friday or door buster sales.

- The price comparison must be based only on sale price, not including taxes, shipping and handling, delivery costs, warranties or any other charges.

The eligible items for this program are pretty straightforward: Any purchase made by your Citi credit card. There are some items ineligible for this program and they are broken down under the Citi Price Rewind Guide.

Sweet Spot:

I can’t remember how many times I’ve seen a price drop on a recent item I purchased online. Some stores are willing to honor these price drops, but many stores don’t have such policies. To know that my credit card will insure these purchases up to 60 days, gives me some real peace-of-mind.

In addition, there are online stores that will offer an item such as a TV at a higher price and include a gift card for several hundred dollars. Essentially, you could buy the TV, pocket the gift card, and then receive a credit for the difference through the CIti Price Rewind program. Another way to maximize this program is to use cash back programs such as eBates or Upromise to get cash back earnings on the higher priced item and then receive the difference in price through the Citi Price Rewind program. If you have moral issues with these methods then don’t use them! Regardless, I love this program and having the comfort of knowing my next big purchases will be protected through Citi!

Have you used this program before? What have your experiences been? Please share in the comments!