Update: This deal is dead. The offer has reverted to its normal 30,000 point sign up bonus.

Chase has finally increased the sign up offer on the United MileagePlus Explorer Card to 50,000 points when you spend $2,000 in 3 months. This increased offer will last through September 2. You can earn an additional 5,000 points when you add a user to your account and a $50 statement credit, along with the annual fee waived for the first year. Chase used to offer 50,000 points regularly for this card and most people have success signing up for the 30,000 point offer and private messaging Chase to match them to the 50,000 point offer.

United devalued their program this past February and they’ve recently announced changes to the way you earn elite status and points with the airline, similar to Delta’s announcement. With their new revenue based earning program coming into effect in the near future, the Chase Ultimate Rewards program which includes Chase Sapphire Preferred and the Chase Ink Business cards, along with the Chase United MileagePlus Explorer card, will be the best way to earn points for the United MileagePlus program. With bonus spending categories and making daily purchases with your credit cards, you’re more likely to earn points at a faster rate than with flying United every so often.

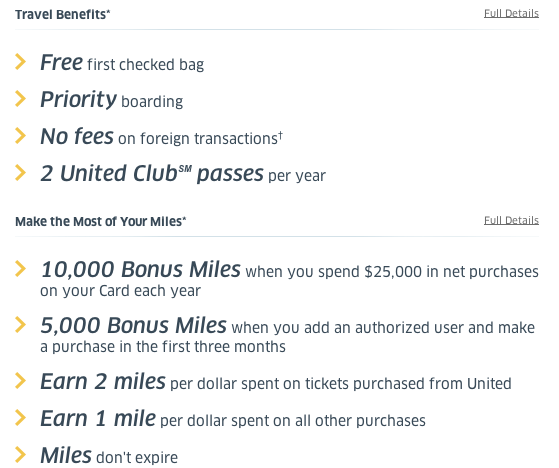

One of the perks of having the United MileagePlus Explorer card, besides the free checked bag, priority boarding, and two annual lounge passes, is the increased award availability when searching for award flights on United.com. United has some solid availability for award tickets but I wouldn’t necessarily book through United for business or first class tickets, especially with their Star Alliance partners as the points needed to redeem this flights has been hiked tremendously.

If you’ve never had this card before or you’ve received the bonus for this card over 2 years ago, you are eligible for the increased sign up bonus on this card. I would sign up for the card, take the 55,000 points + $50 statement credit, 2 lounge passes, and use the card for a year before downgrading or canceling the card. Why not take the free points and enjoy the perks for a year while making an extra $50 in the process? Sounds like a no brainer to me!