That ugly ‘D’ word. Devaluation. Following the countless hotel and airline devaluations, I still see bloggers and readers alike astounded and surprised by United’s latest devaluation that mirror’s the one announced by Delta back in February. Now, United’s latest devaluation doesn’t directly affect me and I imagine it won’t affect a lot of other people, but those that are loyal to United, have elite status, or are avid mileage runners, today’s news does not sit well with them.

This “program update,” as United is calling it, doesn’t change the points requirements needed to achieve elite status with the airline. I also wrote about why I think travel and award enthusiasts like myself will have to diversify their point holdings and perhaps focus on some credit cards like the Barclaycard Arrival Plus™ World Elite MasterCard® that can be used to buy their airline tickets and receive a statement credit. Airline loyalty may just be a thing of the past.

United’s Devaluation:

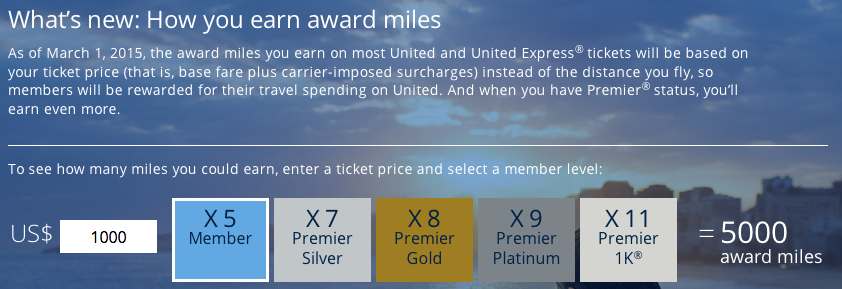

Now, instead of earning United MileagePlus points according to the distance you fly, the points will be revenue based and depend on the amount you pay for your ticket (include fuel surcharges but not taxes). So if you spend $1,000 for a roundtrip flight from LAX to Istanbul and you don’t have any elite status, instead of earning over 13,700 miles, you only receive 5,000 miles. That’s about a 175% decrease in point accrual!

The new revenue based point accrual will come into effect starting March 1, 2015. So even if you’re a Premier 1K member, and you pay for first class tickets, you cannot receive more than 75,000 points for any ticket. This could potentially be great, as I pointed out in the same devaluation released by Delta, that those who pay full price or fly for business purposes, can potentially earn many more points for short-haul flights that cost them hundreds of dollars. I know my sister-in-law had to book a last second one way ticket on Delta from JFK-Detroit for over $700 and only received a few hundred miles for the flight. Now, when these devaluations come into effect, she can essentially earn thousands of points for that same flight.

Chase Credit Cards Remain Valuable for MileagePlus Points Accrual:

This devaluation makes The Chase United MileagePlus Credit Card and the Chase Sapphire and Ink Cards that accrue valuable UR points, even more important than before when looking to accrue United MileagePlus points. You can earn points at a much higher rate and reap in the credit card sign up bonuses, if you haven’t already, and transfer them to the United MileagePlus program at a 1:1 ratio. As I said before, this devaluation won’t really affect me so much as I plan on accruing points through credit card spend and sign up bonuses rather than purchasing my airline tickets directly with United.com

Overall:

Overall, I can’t say I didn’t see this coming and I’m pretty sure American Airlines would’ve followed suit as well if they weren’t in the midst of merging. We shouldn’t see a devaluation from them until 2015 when they officially integrate with US Airways. This makes their 100,000 point sign up offer with the Citi Executive AAdvantage World Elite MasterCard even more desirable of a card. The devaluation may not affect a lot of us, but for those of us that are affected, it may be time to start rethinking your points and credit card strategies, and most of all, your airline loyalty.

Trackbacks/Pingbacks