I tend to wait a minimum of 3-6 months before applying for new credit cards and I try to apply for at least two or more cards from specific banks out there. This time, I decided to go ahead and take advantage of the many great increased credit card sign up offers that popped up over the last month. For those of you unfamiliar with the term, an App-O-Rama is when you apply for multiple credit cards in a short amount of time. I usually try to apply for 4-6 cards on the same day. This helps to minimize the effect of inquiries and any new open accounts on your credit score. If you are new to churning and/or have limited credit card history, I’d recommend starting with 1-3 cards until you’ve built up sufficient length of credit history and accounts in good standing. I always try to maintain a credit score greater than 750 so I will check it before each App-O-Rama. I will speak more on impact on the credit score later on in the post. Lastly, only consider App-O-Rama’s and credit card churns in general if you plan to pay off your balance in full every month. Any interest charged and accumulation of debt is likely to overweight the benefits of sign-up bonuses.

First Steps

Keeping track of your applications and open accounts is one of the most important facets of maximizing the benefits of credit cards. When I first started applying for cards in the beginning of college, my organization was lacking and almost caused me to miss meeting the minimum spend requirements on a few cards. Detailed tracking is CRUCIAL to the App-O-Rama process.

The next step is to identify which cards you plan to apply for. This is where good tracking can come in handy if you plan on applying for cards you’ve had previously as you can determine how long it has been since your last application. Besides evaluating current offers, you should decide what the goal is for your applications. For this App-O-Rama I decided to focus on programs in which I currently have a large amount of miles/points as well as building up points in a new program. I chose to apply for cards to boost my American Airlines and Chase Ultimate Rewards Points accounts. Additionally, I chose to apply for two Starwood cards as I don’t currently have any points with that program and to utilize their favorable airline points transfers.

Credit Card Applications

Citi Executive AAdvantage World Elite MasterCard

Citi released a fantastic sign up offer for their Executive AAdvantage World Elite MasterCard with 100,000 point bonus when you spend $10,000 in 3 months. The spend was a bit high, but using Amazon Payments and a couple of manufactured spending methods, spending $10,000 in 3 months wasn’t too difficult. The annual fee of $450 is a bit steep, but the sign up offer included a $200 statement credit after your first purchase, which made the card much more manageable, especially for 110,000 points! The card includes access to the Admirals Club lounges for you and up to two traveling guests as well as free checked bags and priority boarding for the cardholder and a companion. I’m not sure how much longer this increased offer will last so I jumped on it while I still could!

Chase’s Ultimate Rewards programs offers some of the best transfer options in the industry to various airline, hotel, and other partners. As such, I highly value the redemption options and flexibility of these points and try to sign up for as many Chase UR products as possible. Chase recently upped their sign up bonus for the Ink Cards from 50,000 points to 60,000! With such a great card that includes 5x points for each dollar spent at office supply stores, I maximized my earning by purchasing Visa Gift Cards from Staples.com to meet the spending threshold and uploaded the gift cards onto my Bluebird, effectively earning me 85,000 points! That’s enough for a free roundtrip ticket to the Middle East on United, a free one way on Korean Air’s First Class to Seoul, a free one way on Singapore’s First Class A380 Suite (with miles left over), over 4 free nights at a category 4 Hyatt hotel, and more!

Unfortunately, the increased offer expired on June 1st, but the 50,000 point sign up bonus is still a fantastic offer. The annual fee of $95 is waived for the first year and some additional benefits include two lounge passes per year in the Lounge Club program. The spending requirement of $5,000 in 3 months is not bad, but if you’re thinking of applying for the Citi Executive AAdvantage World Elite MasterCard at the same time, it may be tough for some to meet the spending for both – so make sure to strategize and plan accordingly when applying for multiple cards.

Starwood Preferred Guest American Express Personal & Business

Most credit card and reward travel enthusiasts will agree that the American Express Starwood Preferred Guest Card is one of the most valuable cards and reward programs available. Starpoints provide tremendous flexibility in terms of using your points to transfer to dozens of airlines in increments of 20,000 points and receiving an additional 5,000 points to get 1.25 airline miles per 1 SPG point. Starwood also boasts an impressive hotel portfolio with redemptions at over 1,100 fantastic hotels worldwide starting as low as 3,000 points per night!

Amex just released an increased offer of 30,000 points instead of the usual 25,000 for both the consumer and business cards when you spend $5,000 in 6 months. 6 months to meet the spending requirement is a lot more manageable when applying for multiple cards at a time. If you need a referral for this limited time offer, email me at theflymiler@gmail.com and I can forward you a link for both the business and consumer card. That’s a potential of 70,000 Starpoints! The annual fee of $65 is waived for the first year. One significant benefit is that for each card you get 2 stays and 5 nights credit towards SPG elite status per year. This is valuable for those looking to obtain status with the lowest amount of stays. Make sure to apply and get approval by June 30th to receive the offer!

Other Cards I’m Considering for My Next App-O-Rama with Increased Sign Up Offers

US Airways® Premier World MasterCard®

Barclaycard improved their sign up offer to 40,000 points after you make your first purchase and complete payment of the $89 annual fee for a limited time. US Airways just recently joined the oneworld alliance and can now book flights with American Airlines, Cathay Pacific, British Airways, and more at some really great redemption values. As US Airways and American Airlines are to officially merge in 2015, this seems like one of the last opportunities to apply for a card which will most likely be discontinued once the merger is complete. If you’re looking to take advantage of some of the great redemption offers from US Airways, like flying to Asia from North America in Business class for only 110,000 points roundtrip with a free stopover in Europe, then this card is definitely one worth signing up for!

This card offers additional benefits including Zone 2 priority boarding on US Airways flights, first-class check in, one complimentary US Airways Club pass every year, and an annual companion certificate good for up to 2 companion tickets at $99 each plus taxes and fees.

Premier Miles & More® World MasterCard®

For some time last year, many of us got excited about the 50,000 point bonus sign up offer for the Miles & More credit card offered by Barclaycard that offered valuable points in the Lufthansa, Brussels Airlines, Swiss Airlines, and many more Star Alliance network partners. Lufthansa has one of the best first class and business class products in the sky to go along with one of the nicest first class lounges in the world located at the Frankfurt airport. The offer went away for quite a while but I am pleased to announce that the offer is back for a 50,000 point sign up bonus that gives us better access to their premium class award tickets and it will cost less points than required by United thanks to their recent devaluation. Be aware that Lufthansa does tend to charge high fuel surcharges for their premium cabin award tickets, but it’s definitely worth the price for such a great product. The Miles & More award chart can be used to book flights with combined airlines in the Star Alliance network such as United at cheaper rates (17,000 points for a one way transcontinental first class ticket instead of 25,000) as well as an around the world ticket starting at 180,000 points in economy.

Earn 20,000 points after your first purchase and an additional 30,000 points after you spend $5,000 in 3 months. The card comes with a $79 annual fee but includes a free companion ticket after you make your first purchase and an additional companion ticket on every anniversary of your card opening. I’ve always wanted to take advantage of Lufthansa’s fantastic first class product that has a full seat and a lie-flat bed next to it on their 747 airplanes. Their business class products also offer lie-flat beds and my mom enjoys sleeping on her journey all the way from California to France when she goes to visit her parents. Sign up now and do the same!

After Applying

I received instant approval for the Starwood Preferred Guest American Express Business Card and received pending approvals for both the Citi Executive and the Chase Ink Cards. It’s important to contact the credit card companies right away to find out if you can move around some credit to open the card or answer a few questions they may need to issue you the card. Banks don’t like to extend too much credit if you already have multiple cards with them. Read here about how I’ve called the credit card companies in the past to get my cards approved. For the Citi card, they just verified my name and address and approved me on the spot! For the Chase Ink Bold, they asked me a bunch of questions regarding my business and after finally satisfying all their inquiries they approved my application. If you wait for a decision in the mail, you most likely will have to wait a couple of weeks and might get a rejection later, so definitely call up if you don’t get an instant approval.

Credit Score Impact

Many people I talk to are wary of applying for multiple credit cards because they are worried it will have a detrimental impact on their credit scores. In fact, this could be further from the truth. If you manage your finances well and pay in full every month, having many credit lines is a great way to build credit. Paying in full and on-time and maintaining some accounts for long periods of times are all factors which should increase your credit score over time.

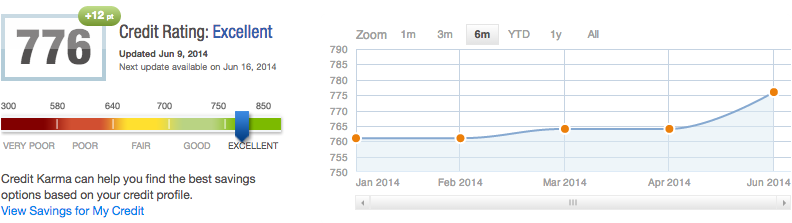

Before my App-O-Rama, my credit score was 764 (pulled in April). Looking at my score in June, my score actually went up 12 points to 776! Although I opened more cards, my utilization went down as my overall credit limit was higher. Note that although I had a favorable credit score change, everyone’s situation will be different based on many factors including but not limited to, number of open credit lines, average of of open lines, etc.

What’s Next?

Given that I normally like to wait at least three months before another App-O-Rama, I like to emphasize to my readers the importance of jumping on great credit card offers when they come up. You never know when another good deal might come out and you want to earn points in advance of your next trip so that you’re able to plan and go as you please. It’s also important to not horde all your points in one loyalty program and keep your points diversified for flexibility as some programs tend to devalue their points or you may need the option to book with different hotels or airlines.

Make sure you keep track of the cards that you apply for and ensure that you reach the minimum spend requirements to receive the full sign-up bonuses. The minimum spend for this App-O-Rama is $20,000 which is the highest I’ve attempted yet. However through multiple means of spending such as Bluebird, adding relatives as authorized users, and everyday expenses, I should have no problem meeting the requirements in time. If you have any questions post below or email me at theflymiler@gmail.com. Good luck!

I’ve been exploring for a little for any high quality articles or blog posts on this sort of area .

Exploring in Yahoo I finally stumbled upon this website.

Reading this info So i’m glad to express that I’ve an incredibly excellent uncanny feeling I found out exactly what I needed.

I such a lot no doubt will make sure to do not omit this site and give it a look regularly.