We previously brushed up on the Chase Ultimate Rewards Program and why they are considered amongst the most valuable award points for free travel redemption. We also mentioned the various ways to earn Chase UR points with multiple Chase credit cards, but in this post, I’d like to explain why I think the Chase Ink Bold & Plus cards are must-have cards for not only businesses but for consumers as well.

How to apply for a Chase Ink card without owning a registered business:

If you don’t run a registered company, an LLC, or any type of business entity, don’t fret as this won’t keep you from being eligible to hold a Chase Ink card. Everyone runs a side business, whether it be selling items on eBay or Amazon, or collecting watches and stamps as a hobby. The Chase Ink cards allow you to compartmentalize your spending by user as a statement is prepared for each card/employee and the money you spend using your Ink card is not reported on your credit score.

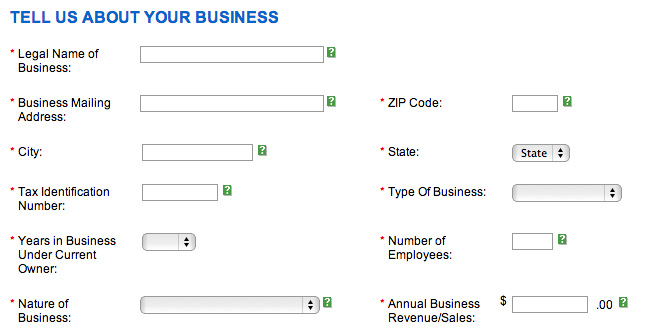

When you apply for a Chase Ink Bold or Plus card, make sure you fill in the “legal name of business” with “Your Name” Sole Proprietorship. For example, my legal name of business would be “Julien Bortz Sole Proprietorship” if you don’t have a registered business or legal entity. In the “tax identification number” box, you will fill in your social security number instead.

Earn up to 5x points with Chase Ink cards:

Earn 5x points for every dollar spent on:

- Telecommunications (cell phone, cable, internet, and satellite TV bills).

- Office supply stores such as Staples, OfficeMax, and Office Depot. These stores carry gift cards for many stores that can help you rack up a ton of points. Instead of using your credit card to make purchases directly with stores like Macy’s, Sephora, AMC movie theaters, restaurants, or even Amazon.com, go to an office supply store and buy gift cards there with your Ink card to receive 5x points!

Earn 2x points at gas stations (many gas stations also carry gift cards) and 2x points for hotels for up to $50,000 worth of spending in bonus categories each year, which equates to a potential 250,000 bonus points!

Bonus Perks:

Receive 2 Free lounge passes with this card and every additional user card you have by signing up with this link: loungeprogramenroll.com/inkcard

Ultimate Rewards:

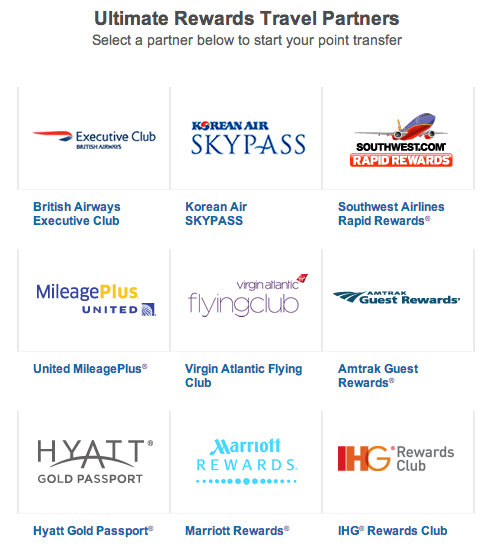

Ultimate Rewards is by far one of the most valuable travel reward programs in existence. Chase UR Points are transferrable to multiple airlines and hotel chains giving you the freedom and flexibility to transfer your points instantaneously to make a booking of your choice. Travel programs include British Airways Executive Club, Korean Air SKYPASS, Southwest Airlines Rapid Rewards®, United MileagePlus®, Virgin Atlantic Flying Club, Amtrak Guest Rewards®, Hyatt Gold Passport®, Marriott Rewards®, IHG® Rewards Club and The Ritz-Carlton Rewards®.

United is a valuable program to transfer to as they have amazing award availability and don’t have fuel surcharges on flights overseas. Redeem 25,000 points for a free round trip ticket from Los Angeles to New York, while 60,000 points can get you a free round trip ticket to Europe and a free stopover. Or redeem points for flights at as little as 4,500 points using British Airways Avios! British Airways is an amazing award partner with an award chart that goes according to the distance that you fly. Read my post about why British Airways Avios points are so valuable and how you can redeem free trips for only 4,500 points.

Korean Air has leading first class service to Asia with first class flights redeemable at only 80,000 points each way! United will charge up to 120,000 points to fly to Asia in first class with their partner airlines. Read about Korean Air’s leading first class service and about transferring your UR points to Korean Air, a member of the Star Alliance network.

You can redeem nights for as little as 5,000 points or if you’re feeling luxurious, use 30,000 points for a category 7 Park Hyatt hotel in Paris, Tokyo, or Sydney among others that go for over $1,000 a night! Hyatt has the best value of any hotel reward program in my opinion and you can combine cash with points to stay more nights for less.

Also, if you like to make online purchases at your favorite stores, you can earn up double, triple or up to 15x or even 30x points when using the Chase Ultimate Rewards shopping portal to shop through online retailers such as Kohls, Macy’s, Amazon, Sephora, and Groupon.

- Earn 50,000 bonus points after you spend $5,000 in the first 3 months from account opening. That’s $625 toward travel when you redeem through Chase Ultimate Rewards.

- Flexibility to pay your balance over time or in full

- Earn 5X points per $1 on the first $50,000 spent annually at office supply stores, and on cellular phone, landline, internet, and cable TV services

- Earn 2X points per $1 on the first $50,000 spent annually at gas stations and for hotel accommodations when purchased directly with the hotel

- No foreign transaction fees

- 1:1 point transfer to popular frequent travel programs with no transfer fees

- $0 Intro Annual Fee for the first year, then $95.

If you and your spouse get a Bold and a Plus ink card, that’s 220,000 points that can be used for multiple round trip tickets to Europe, South America, Australia, or Asia after meeting the spending threshold! If you are worried about meeting the spending threshold, then one can buy gift cards to be used at a later date, use Amazon Payments, and get a bluebird card. Also, these cards can be downgraded to the Chase Ink cash or Chase Freedom card to avoid paying the annual fees. Apply now and travel free!