The most important part of the accumulating reward points process, is making sure you are on top of your credit card expenses and sign up bonuses. If you sign up for multiple credit cards at once like I do, then you may have to juggle 3 or 4 different sign up bonuses. I like to put my credit cards on automatic payment so I don’t have to worry about missing a payment or at least have an email sent out to me warning me of an upcoming payment due. Always make sure you pay off your credit card in full each month in order to avoid the heavy interest fees that come along with travel reward credit cards.

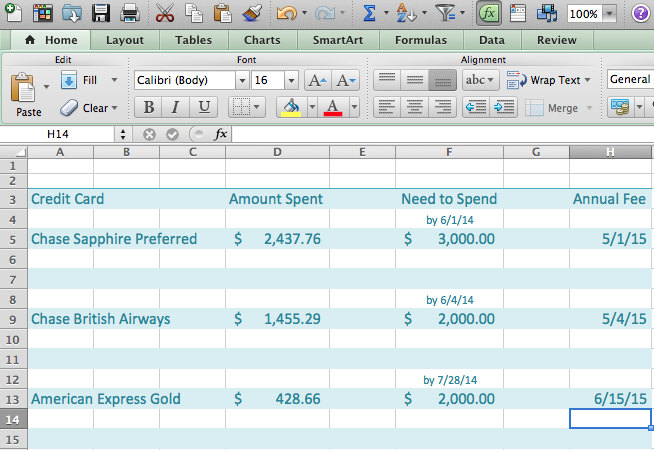

The best part about travel reward credit cards are their sign up bonuses. The key is to make sure you are meeting the spending threshold for each card. For example, with the Chase Sapphire Preferred card we need to spend $3,000 in the first 3 months of the card opening. I like to track my spending in a spreadsheet and be aware of the due date to complete my spending. I also like to track the annual fee date in order to assess which cards I want to keep, downgrade, or cancel in order to avoid paying the fee and apply for new cards. Some cards are worth keeping and paying the fee. To better understand whether or not to keep a card when the annual fee comes up, read about my annual fee post.