The first thing I tell everyone before applying for a credit card is: If you can’t pay off your credit card statement in full amount at the end of every month then do not get a credit card!

Credit cards can be so valuable when used the right way. The rewards are endless. From elite status in valuable reward programs, to earning hundreds of thousands of points that can be used to book vacations all over the world and save thousands of dollars. Credit cards also offer extended warranties, car rental insurance, exclusive offers to privately held events, and other great perks depending on the card.

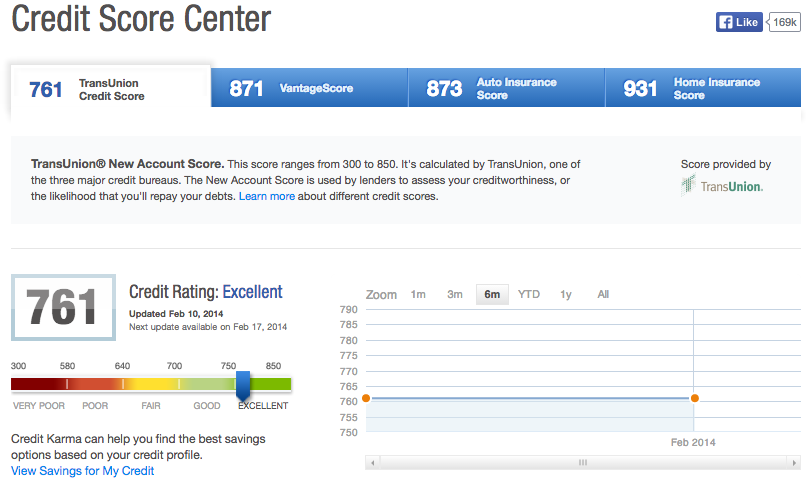

People always ask me: “If I have too many credit cards, won’t my credit score negatively reflect that?” No, on the contrary, if you pay off your statements in full and don’t spend large amounts of credit limit that is extended to you by the credit card companies, then your credit score will positively reflect that. I have multiple credit cards and almost $150,000 worth of credit with little income at the moment and my credit score is 760, above average!

One thing to keep in mind is to make sure the card you use the most has the highest credit limit of all your cards. If you have a Chase Sapphire Preferred that has $10,000 credit limit and a Chase Hyatt card with $15,000 credit limit, but you use the Sapphire the most, then you can contact Chase and they will transfer whatever amount you would like to move from one card to the next. If you were to transfer $10,000 from the Hyatt card and give yourself a $20,000 spending limit on your Sapphire card, then your credit limit utilization becomes more optimal. The ratio to which you spend money on a card to its credit limit affects your credit score. So if you were previously spending $5,000 per month on your Sapphire card when you only had a $10,000 credit limit, then you were utilizing 50% of your credit, which can look bad on your score. However, now that you have a $20,000 credit limit, you are only utilizing 25% of your limit and therefore improving your utilization ratio.

If you would like to check your credit score and track your credit card application openings for free, I recommend using Credit Karma. You can track your accounts as well as note the different factors that affect one’s credit report. Also, to avoid getting too many credit pulls when applying for multiple credit cards, see my article on 2,3,4 browser method.