It’s been over six months since my last batch of applications so it’s time for my first App-O-Rama of 2014. For those of you unfamiliar with the term, an App-O-Rama is when you apply for multiple credit cards in a short amount of time. I usually try to apply for 4-6 cards on the same day. This helps to minimize the effect of inquiries and any new open accounts on your credit score. If you are new to churning and/or have limited credit card history, I’d recommend starting with 1-3 cards until you’ve built up sufficient length of credit history and accounts in good standing. I always try to maintain a credit score greater than 750 so I will check it before each App-O-Rama. I will speak more on impact on the credit score later on in the post. Lastly, only consider App-O-Rama’s and credit card churns in general if you plan to pay off your balance in full every month. Any interest charged and accumulation of debt is likely to overweight the benefits of sign-up bonuses.

First Steps

Keeping track of your applications and open accounts is one of the most important facets of maximizing the benefits of credit cards. When I first started applying for cards in the beginning of college, my organization was lacking and almost caused me to miss meeting the minimum spend requirements on a few cards. Detailed tracking is CRUCIAL to the App-O-Rama process. Refer to this post for ideas on keeping track of your credit cards.

The next step is to identify which cards you plan to apply for. This is where good tracking can come in handy if you plan on applying for cards you’ve had previously as you can determine how long it has been since your last application. Besides evaluating current offers, you should decide what the goal is for your applications. For this App-O-Rama I decided to focus on programs in which I currently have a large amount of miles/points as well as building up points in a new program. I chose to apply for cards to boost my American Airlines and Chase Ultimate Rewards Points accounts. Additionally, I chose to apply for two Starwood cards as I don’t currently have any points with that program and to utilize their favorable airline points transfers.

Credit Card Applications

US Airways Premier World MasterCard

Although the American Airlines AAdvantage program doesn’t have the same award availability and redemption value as United MileagePlus, there are a large amount of distinct credit cards for building up miles. As US Airways and American Airlines are in the process of merging, this seemed like one of the last opportunities to apply for a card which will most likely be discontinued once the merger is complete. I opened up an US Airways account with the full intention of having my points combined with my AAdvantage account when the programs are combined.

At the time of applying, the US Airways Premier World MasterCard offered by Barclays had a sign-up bonus of 35,000 Dividend Miles upon first purchase. The annual fee of $89 is waived for the first year. This card offers additional benefits including Zone 2 priority boarding on US Airways flights, first-class check in, one complimentary US Airways Club pass every year, and an annual companion certificate good for up to 2 companion tickets at $99 each plus taxes and fees.

CitiBusiness AAdvantage World MasterCard

As I’ve been a cardholder of many of Citi’s personal AAdvantage credit cards, including some which I’ve applied for in the past few years, I decided to apply for the CitiBusiness AAdvantage World MasterCard. The offer available at the time was for 50,000 AAdvantage miles after spending $3,000 in the first three months. The annual fee of $95 is waived for the first year and other benefits include first checked bag free, group 1 boarding, 25% savings on eligible in-flight purchases, etc. Also, check out the limited time 100k offer on the Citi Executive AAdvantage World MasterCard.

Chase’s Ultimate Rewards programs offers some of the best transfer options in the industry to various airline, hotel, and other partners. As such, I highly value the redemption options and flexibility of these points and try to sign up for as many Chase UR products as possible. Chase usually doesn’t allow multiple sign up bonuses to be earned if you’ve had the same product before. I am a current holder of the Chase Ink Plus business credit card, however the Chase Ink Bold is a separate product. Although both cards are virtually identical in terms of bonuses, earnings rates, and benefits, the Chase Ink Bold is a charge card which means that it must be paid in full every month. Again, make sure you are able to pay in full every month before applying for this or any other cards.

The sign-up bonus at the time was 50,000 Ultimate Rewards points after spending $5,000 in three months. The annual fee of $95 is waived for the first year and some additional benefits include two lounge passes per year in the Lounge Club program. Although this is a large minimum spend, there are many ways to complete this requirement which can be found here.

Starwood Preferred Guest American Express Personal & Business

One of the first credit cards I signed up for when I began to realize the values of credit cards for free travel was the Starwood Preferred Guest American Express. However, it’s been a few years since I was last a cardholder and I was reminded recently of the flexibility of SPG points. Besides hotel redemptions, you can transfer SPG points with a 1:1 ratio to various airlines programs including American Airlines, Lufthansa, and US Airways. Also, transfers in increments of 20,000 points will receive an additional 5,000 points so you get 1.25 airline miles per 1 SPG point.

As the Personal and Business cards are considered separate products, I chose to apply for both at the same time. Each card offered a sign-up bonus of 10,000 SPG points upon first purchase and 15,000 more after spending $5,000 in six months. The annual fee of $65 is waived for the first year. One significant benefit is that for each card you get 2 stays and 5 nights credit towards SPG elite status per year. This is valuable for those looking to obtain status with the lowest amount of stays.

After Applying

I only received instant approval for one of the five cards, the Starwood Preferred Guest American Express Personal Card. For the remaining four cards, my application was pending further review so I called the respective reconsideration lines. Calling reconsideration lines is one of the best ways to get approved for cards. There are multiple reasons why you may not be approved instantly. Sometimes, a bank didn’t want to extend me any more credit as I already had multiple cards open with them and other times they wanted someone to spend more time looking at my application.

For the US Airways Premier World MasterCard, the analyst mentioned that I already had a recent account open with them which was the Frontier Airlines credit card I had applied for in June of 2013. I mentioned that I was willing to transfer some of the credit limit from that card to the US Airways card. He was able to process this request and approved my card immediately! It never hurts to offer to move credit limits around or even close exisitng cards if you will no longer be using them.

For the remaining three cards, the credit analysts just confirmed my income and were able to approve my cards. By calling the reconsideration line, I was able to get all of my cards quickly approved with minimal effort and no wait times. I’m looking to earn over 200,000 points just from signup bonuses that will be good for thousands of dollars worth of free travel! A pretty good day’s work if you ask me.

Credit Score Impact

Many people I talk to are wary of applying for multiple credit cards because they are worried it will have a detrimental impact on their credit scores. In fact, this could be further from the truth. If you manage your finances well and pay in full every month, having many credit lines is a great way to build credit. Paying in full and on-time and maintaining some accounts for long periods of times are all factors which should increase your credit score over time. This post on credit scores provides more information on the real impact multiple applications has.

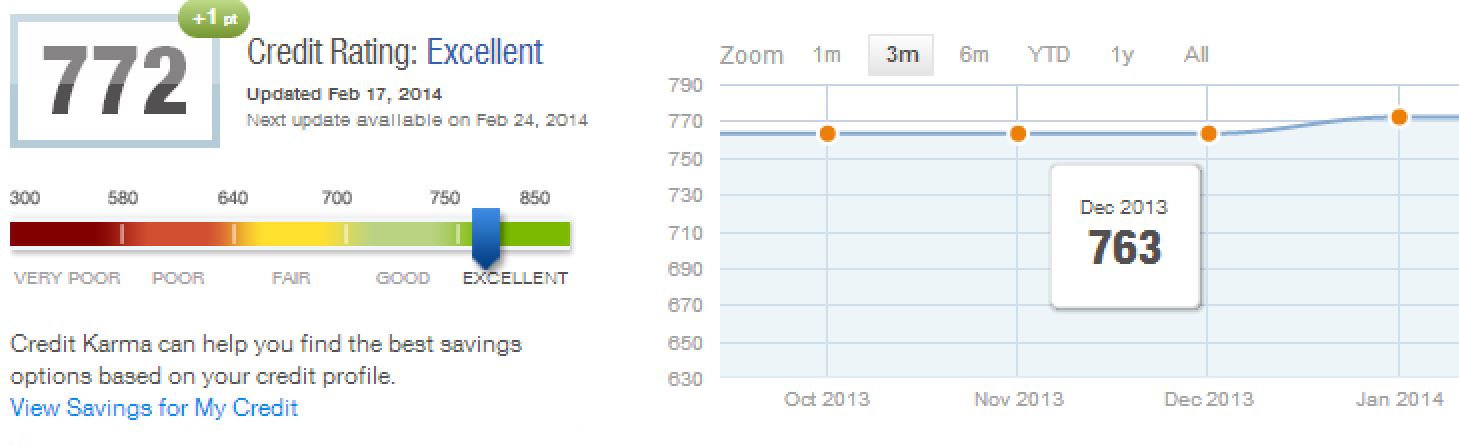

Before my App-O-Rama, my credit score was 763 (pulled in December). Looking at my score in February, my score actually went up 9 points to 772! Although I opened more cards, my utilization went down as my overall credit limit was higher. Note that although I had a favorable credit score change, everyone’s situation will be different based on many factors including but not limited to, number of open credit lines, average of of open lines, etc.

What’s Next?

Given that I applied for a large number of cards, I will most likely wait at least three months before another App-O-Rama. My main focus is to keep track of the cards that I just applied for and make sure that I reach the minimum spend requirements to receive the full sign-up bonuses. The minimum spend for this App-O-Rama is $18,000 which is the highest I’ve attempted yet. However through multiple means of spending such as Bluebird, adding relatives as authorized users, and everyday expenses, I should have no problem meeting the requirements in time.